From 1 January 2026, the Carbon Border Adjustment Mechanism (CBAM) will start to have a direct financial impact. After the transitional period from 2023 to 2025, reporting alone will no longer be sufficient — the carbon emissions embedded in certain imported goods will become a real cost.

CBAM is not a technical formality. It affects pricing, supply chains, and access to the EU market.

Why CBAM Exists

Producers within the EU already pay for their emissions through the EU Emissions Trading System (EU ETS) the world’s largest regulated carbon market, covering 31 countries and more than 11,000 installations. This increases production costs but sends a clear market signal: lower emissions result in lower costs.

The issue arises when the same products are imported from countries without comparable carbon pricing. This creates the risk of so-called “carbon leakage” the relocation of production to jurisdictions where emissions are not priced.

CBAM addresses this by levelling the playing field for goods placed on the EU market.

Which Sectors Are Covered by CBAM

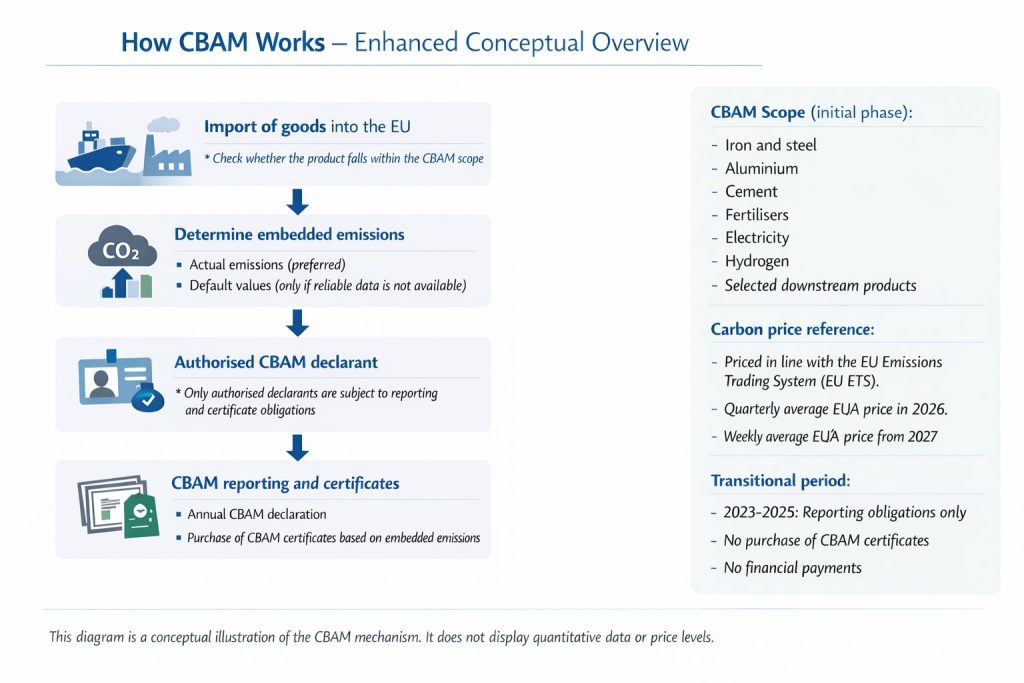

In its initial phase, CBAM applies to sectors with high carbon intensity:

- iron and steel

- aluminium

- cement

- fertilisers

- electricity

- hydrogen

- selected downstream products

The impact also extends to construction, manufacturing, and industrial supply chains.

How the Price Is Determined

CBAM uses the carbon price established under the EU ETS, which operates on a cap-and-trade principle.

- the total number of allowances decreases each year

- prices are determined by the market

- at the beginning of 2026, prices are expected to be around EUR 85–90 per tonne of CO₂

Importers will be required to purchase CBAM certificates:

- based on a quarterly average price in 2026

- based on a weekly average price from 2027 onwards

If a carbon price or equivalent scheme has already been paid in the country of origin, this amount may be deducted from the CBAM obligation. This mechanism is designed to prevent double carbon pricing.

As a result, carbon intensity becomes a direct component of product cost.

Transitional Period

The transitional period ran from 2023 to 2025 and involved reporting obligations only, without financial payments or the purchase of CBAM certificates.

Why CBAM Is Controversial

CBAM has a climate objective but also significant economic implications:

- protection of EU competitiveness

- increased trade tensions with non-EU partners

- challenges for developing economies with limited access to low-carbon technologies

- for businesses, emissions data become a commercial requirement, not merely a regulatory one

What CBAM Really Tests

CBAM does not test regulatory awareness. It tests the maturity of data, processes, and supply chain management.

Companies with reliable measurement and traceability can reduce regulatory risk and make more informed commercial decisions.

In this environment, clear and verifiable data become a competitive advantage.